Establishing a Land Bank in South Bend & St. Joseph County

A Decision-Making Roadmap

Topic(s): Land Banks, Local Analysis

Published: September 2023

Geography: Indiana

Author(s): Center for Community Progress

In January 2023, the City of South Bend, Indiana engaged Community Progress to assess the feasibility of a land bank and provide a road map of critical decision points.

One of the most notable endeavors of the last decade was the City of South Bend’s “1,000 Houses in 1,000 Days” initiative, launched in 2013. The goal was to address, through demolition or repairs, 1,000 abandoned houses that were causing the most harm to neighbors and neighborhoods. At the conclusion of the initiative in 2015, the City had addressed 1,122 dilapidated, vacant homes with roughly 40 percent of them repaired and 60 percent demolished. The impressive scale and success over just two years should be attributed largely to the thoughtful work of the South Bend Vacant and Abandoned Properties Task Force.

However, there was one unintended consequence of this herculean undertaking: the hundreds of unmaintained, privately and publicly held vacant lots resulting from the demolitions. These lots dot the neighborhoods of South Bend, concentrated in the southwest and northwest corridors that are also home to the highest concentration of residents of color.

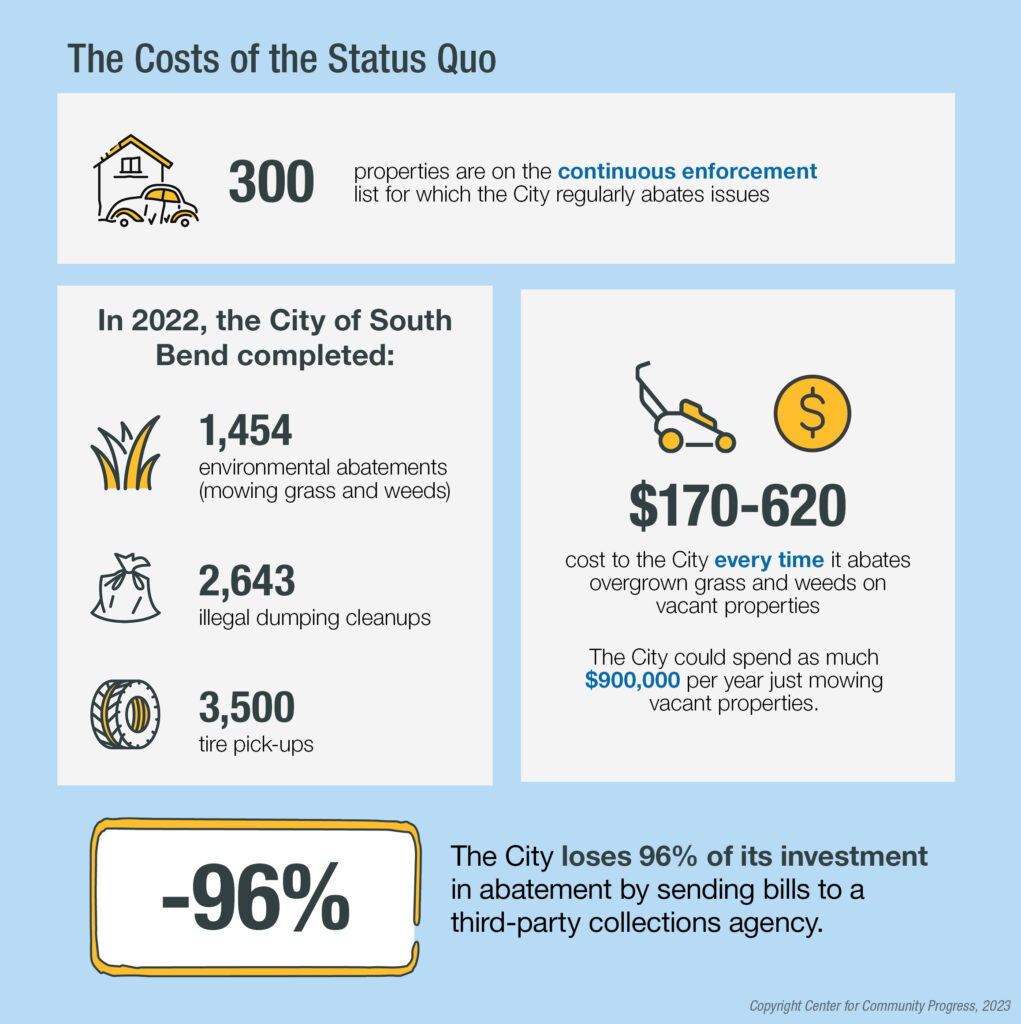

On the surface, a vacant lot may not seem terribly problematic. But when owned by an out-of-town limited liability company (LLC) or an individual who has long since walked away, giving up their responsibilities to maintain their property and pay taxes, these vacant lots become a huge burden to the City. Public taxpayer dollars go towards cutting the grass, removing the trash, and responding to public safety concerns. These properties also harm their neighbors and the neighborhood by bringing down property values and diminishing the hard-earned equity that owners could and should be able to pass down to future generations.

This report identifies what keeps vacant properties, especially vacant lots, stuck in a cycle of decline—and how a land bank might help. While substandard occupied properties are also a crucial issue, they require a very different approach given the importance of protecting the people living there.

Over eight months, the Community Progress technical assistance team requested and analyzed parcel data to better understand the scale of vacant, abandoned, and deteriorated (VAD) properties and a land bank’s potential inventory. Community Progress also conducted virtual and in-person sessions with a wide range of public and community stakeholders.

Community Progress identified the following key takeaways:

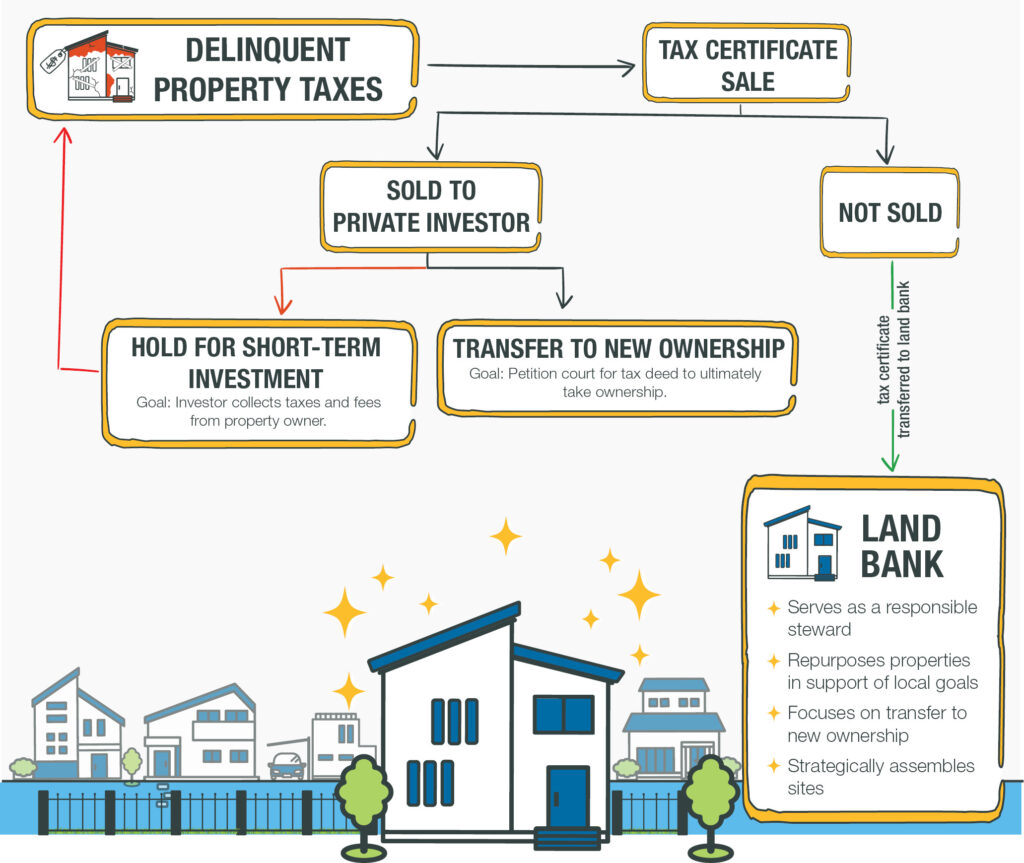

Primary Challenge

Despite efforts by public and community leaders, an inventory of VAD properties still cycles through the tax sale system. This is because many tax lien buyers are primarily interested in the short-term financial gain and not in taking title to the property.4 Significant portions of VAD properties offered at tax sale have been cycling for over 10 years, therefore severely underwater in value and unattractive to the private market. The most effective intervention is to sell the actual property (not the debt) to a new responsible owner or transfer at nominal cost to a land bank to stop this cycle. Then, these properties can be stewarded back to productive use and responsible ownership in line with community priorities.

Land Bank

A land bank could be a valuable tool for the City of South Bend and St. Joseph County if both local governments work together. A collaborative, transparent, and comprehensive approach from a joint City-County land bank would be the best option, given most VAD properties are in the City and the County has jurisdiction over the pipeline of properties through the tax sale system. It is worth seriously considering a third-party entity to operate the land bank, as it could provide expertise, neutrality, flexibility, and transparency in fully utilizing this new tool.

Community Engagement and Partnerships

Continuing to engaging and build relationships with residents most impacted by VAD properties and nonprofits committed to revitalization in South Bend is critical. The City and County can more readily achieve their housing objectives by expanding partnerships. This includes with local nonprofits and affordable housing developers and creating an inexpensive, accessible pipeline of properties.

Current Toolbox and Potential Legislative Changes

A land bank will only be effective with changes to tool utilization and state law changes enabling additional tools. Though City and County have a decent set of legal tools available in state law, a land bank will only be effective if there is coordination of existing tools—like delinquent property tax enforcement and code enforcement—and consideration of new tools that are not yet available in state law, that could help bypass the harmful practice of selling delinquent property taxes to private buyers. The City and County should also consider working with other Indiana communities to strengthen the Indiana Land Bank Act by improving land bank access to tax-delinquent properties and funding options.

Availability of Data

There is an opportunity to improve and centralize how the City and County collect and manage data. Improved data would help better understand of the inventory of VAD properties, determine which to prioritize for code enforcement, and which might be better addressed by a potential land bank.

Decision Points and Recommendations

If a joint City-County land bank moves forward, and the County agree to use its authority in the enforcement of delinquent property taxes to provide a proposed land bank cost-effective access to VAD properties causing the most harm, leaders should consider the following decision points and recommendations:

Decision Point #1: Land Bank Formation and Governance

A. Consider forming a land bank via interlocal agreement between the City of South Bend and St. Joseph County.

B. Be responsive to address properties throughout St. Joseph County.

C. Prioritize board members with relevant expertise and who represent the communities where the land bank will work.

D. Consider forming an advisory committee of residents, partner organizations, and allied groups. The advisory committee should represent communities most impacted by vacancy and abandonment.

Decision Point #2: Type of Organization

A. Consider establishing the land bank as a nonprofit entity.

B. Designate the City as the governmental entity responsible for establishing the nonprofit.

Decision Point #3: Priorities and Policies

A. Immediately set priorities, policies, and procedures for all land bank acquisitions and dispositions.

B. Revisit priorities, policies, and procedures regularly to ensure they reflect community needs and land bank capacity.

Decision Point #4: Tax Sale Data Management and Analysis

A. Improve data collection and management. This will help better understand the inventory and outcomes of VAD properties cycling through the tax sale system.

Decision Point #5: Initial Inventory

A. Review the tax certificate list to determine which certificates are stuck in the tax sale cycle and are good candidates for land bank intervention.

B. Evaluate existing public inventories and prioritize properties to transfer to the land bank.

Decision Point #6: Future Inventory

A. Consider bidding on targeted properties at the first tax sale, in limited circumstances.

B. Develop a systematized process to transfer deeds for properties that do not sell at the first tax sale to the land bank.

C. Consider bidding at the County Commissioners’ Certificate Sale if there is no systemized process for certificate transfers from the County.

D. Accept and/or request the transfer of publicly owned properties from the City and County.

E. Work with the City to roll unpaid code liens onto the annual tax bill.

Decision Point #7: Capacity and Staffing

A. Consider entering into an agreement to receive land bank staffing services from an existing entity, like

Michiana Area Council of Governments.

B. Establish recurring meetings to discuss, strategize, and align land bank interventions and share knowledge and expertise.

C. Contract with a nonprofit or locally owned company with expertise in property management to maintain land bank properties.

D. Develop partnerships with local nonprofits to acquire and transform land bank properties to address the evolving and expansive needs of the community.

Decision Point #8: Funding

A. Consider committing annual funding to the land bank (City of South Bend).

B. Consider committing startup capital for the land bank and identifying opportunities for future support (St. Joseph County).

C. Consider transferring tax deeds to the land bank for at a cost that covers legal expenses or tax certificates at no charge after the initial six-month period has expired (St. Joseph County).

D. Structure the interlocal agreement to provide 50 percent of property taxes to the land bank for five years from properties acquired and sold by the land bank.

E. Develop a fundraising strategy and solicit commitments from philanthropic partners.

Topic(s): Land Banks, Local Analysis

Published: September 2023

Geography: Indiana

Related Publications

Other Related Content

Subscribe to join 14,000 community development leaders getting the latest resources from top experts on vacant property revitalization.