Judicial In Rem Code Enforcement and Judicial In Rem Tax Sales

This comprehensive analysis of housing and building code enforcement policy and practice in the City of Atlanta was, to our knowledge, the first such analysis to recommend the elimination of criminal housing and building code enforcement, and to point out the profound inequities of same. Additionally, this analysis provided the playbook and inspiration for the City of Atlanta to file liens associated with public demolition of dangerous and substandard vacant properties thereby recouping public investment for the first time in decades when those properties are sold.

Challenge

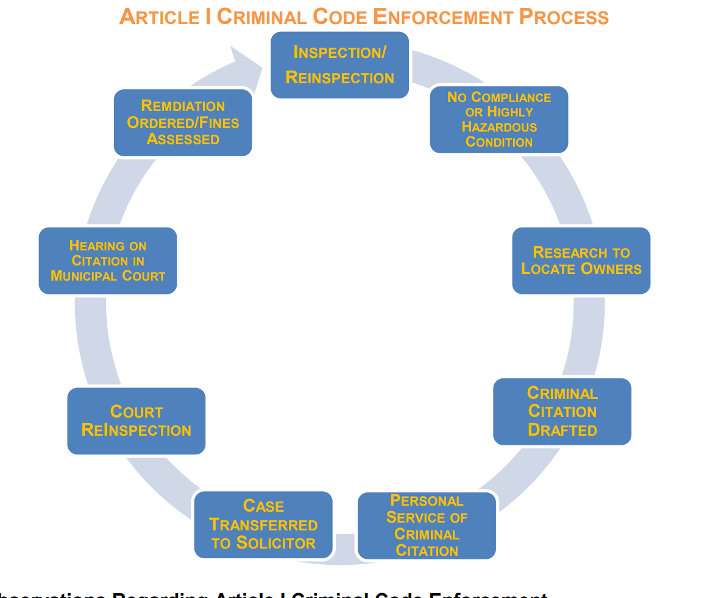

In 2014, vacant, abandoned, deteriorated properties were concentrated in the southwest ring of City of Atlanta neighborhoods, and though occasionally demolitions of exceedingly dangerous properties did take place, those parcels simply remained in the hands of irresponsible/defunct/absentee owners, while the City almost never recouped its taxpayer expended demolition funds. The City of Atlanta criminal code enforcement system was failing to move any of these vacant and abandoned properties into equitable and productive use, and that same system had no impact on corporate LLC property owners, and highly inequitable impacts on low-income owner occupants without the resources to make needed repairs.

Solution

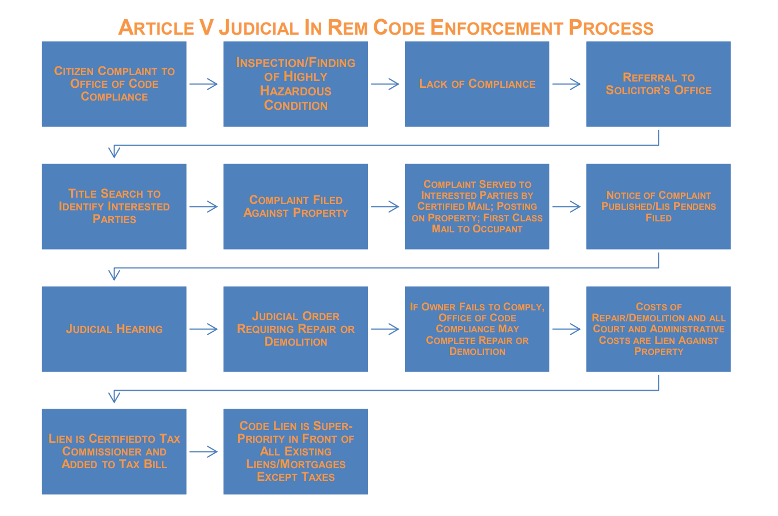

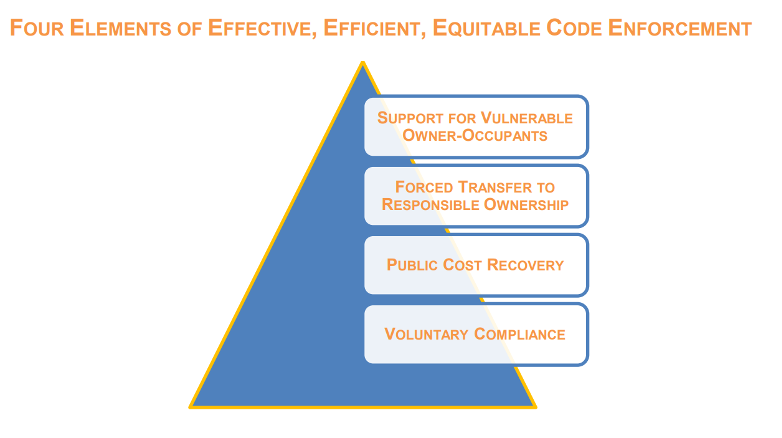

The most important finding described in this report is that the City of Atlanta already has at its disposal the necessary legal and policy tools to maximize the possibility of forcing property owners to fix up problem vacant properties, pay up taxpayer expended funds spent on such properties, or give up problem properties to responsible public or private ownership. A tool called Judicial In Rem Code Enforcement has been on the books in the Atlanta Code for many years—it had simply never been utilized effectively. Similarly, state law has long authorized an effective delinquent tax enforcement tool that may be used in conjunction with Judicial In Rem Code Enforcement—the Judicial In Rem Tax Sale. Instead of utilizing these efficient, effective civil tools to encourage the return of vacant, abandoned property to productive use, the City of Atlanta focused its code enforcement efforts on a criminal process that is burdensome and expensive, and delinquent taxes are currently enforced utilizing a non-judicial process that provides little opportunity to positively impact problem properties. The criminally focused code enforcement process is typically impossible to enforce in the face of the majority of code delinquent properties that are owned by corporate, indigent or out-of-state owners, and it provides no means to attach public funds expended as a priority debt on the property that may force a property transfer to responsible hands. This report describes how Judicial In Rem Code Enforcement and Judicial In Rem Tax Sale procedures work, recommends abandoning criminal code enforcement procedures in favor of these existing civil tools, and makes specific recommendations for the use of these tools in concert with one another on vacant, abandoned and code delinquent properties throughout the City.

Impact

Upon publication of this report and multiple presentations to the Atlanta Code Enforcement Commission and elected leadership, the City of Atlanta a) institutionalized the attachment of liens to publicly demolished properties as a matter of course, quickly recouping significant sums when those properties were sold in a rapidly heating Atlanta marketplace, b) ultimately adopted legislation to attempt civil code enforcement against corporate and LLC owners of nuisance properties, and c) adopted a pilot judicial in rem code enforcement program with funding from Invest Atlanta to attempt the full in rem code enforcement and delinquent tax enforcement program as recommended.

More

This is an optional place to add additional content. Ehenimus magnis corpore icipsuntiur? Pudis quibus doloria spicium dolo tem qui doluptatius, sum eicidellacea volesequo ma sitionsed maiorempori dusciis moluptatquo et volorro qui untibus sus eos sentionsenis et etur mil inus nitas quam enda des experatem volor aut vendi comnis des et laborer chiligentis mo venis eost, omnis modi qui offictemque sitiosanda voluptatus derio occulpa non evelent est, ium corum, sae. Berum arum quia sequi vel et reptamet voloria parchil lorestis quae eos nus quatas dollit ex et volorit occum ilias doluptatusa eossimus dolla dolendi officitae vellutem num re nes moluptat que plant, cus.

Topic(s): Code Enforcement System, Local Analysis, Property Tax System, State/National Analysis

Published: December, 2025

Geography: Georgia

Services: Recommendations, specific re: code enforcement policy and practice

Client: City of Atlanta Code Enforcement Commission

Partners:

This is a place for a client testimonial, quote or project statement. This text can be styled beyond the standard paragraph format if desired.

Shelia Mason, Director of Code Enforcement, City of Atlanta

Interested in these services for your community? We can help! Contact the Technical Assistance Team »

Get the latest tools, resources, and educational opportunities to help you end systemic vacancy, delivered to your inbox.