Analysis of Bulk Tax Lien Sale

In response to Community Progress’ comprehensive analysis of the fiscal and community impacts of Rochester’s bulk sale of tax liens to a private tax lien investor, Rochester ultimately discontinued the sale of tax liens resulting in significant additional revenues collected by the City of Rochester, more equitable outcomes over the properties most harming neighbors and neighborhoods, and a reduction in limbo properties throughout the City of Rochester.

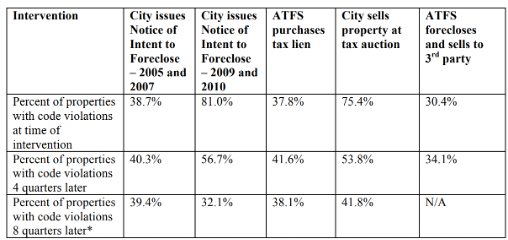

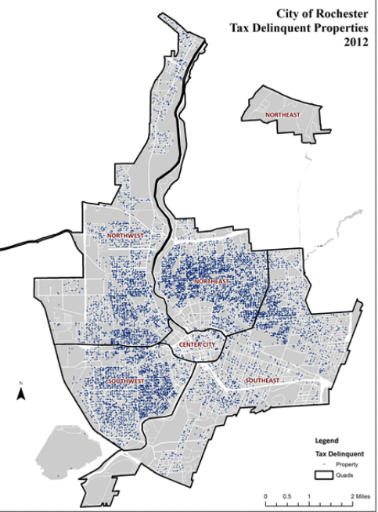

Challenge

Community Progress and its sub-consultant partners conducted a detailed and comprehensive review of all Rochester data regarding liens sold to a private tax lien investor, conducted qualitative interviews and analysis with community stakeholders most impacted by the properties subject to tax liens, and identified a host of both economic and community impacts of the bulk tax lien sale. Such impacts included, for example, a likely under compensation to the City for redeemed liens, and the creation of “limbo properties” beyond control of the City that deteriorate while remaining inaccessible to the market—as they are subject to liens sold to private investor who has no interest in foreclosing on vacant/abandoned properties but rather seeks only the redemptions associated with liens on higher-value parcels. Additionally, Community Progress found that the number of tax delinquent parcels increased after tax lien sale to a private investor, and that tax delinquent properties generally had higher rates of vacancy and code violations, and were more likely to generate police calls and to negatively impact sale prices of nearby homes.

Solution

Community Progress recommended the City of Rochester stop the bulk sale of tax liens to a private investor and simply contract with a third party to service the delinquent tax digest. Community Progress also provided additional alternative proposals in the event the city refused to cease the bulk sale of tax liens, including recommending at least holding back liens associated with vacant, abandoned and deteriorated parcels thereby increasing the purchase price of the remaining digest to an investor, and allowing the City to maintain control over the properties causing the most harm to communities and then to return them to productive use.

Impact

In response to the Community Progress analysis of its bulk tax lien sale, the City of Rochester initially incrementally reduced the sale of delinquent tax liens from about $4,500,000 annually to an average of $2,300,000 annually, and ultimately stopped the bulk tax lien sale process entirely in February of 2020. As a result, limbo properties are no longer created outside the City’s control, the land bank is able to effectively steward vacant properties brought through the City tax foreclosure process, and residents are protected from increasingly aggressive investor tax lien foreclosure practices which may include the addition of attorney fees to avoid foreclosure—a price that can easily be more than the delinquent tax owed.

Topic(s): Code Enforcement System, Local Analysis, Parcel Data & Neighborhood Markets, Property Tax System

Published: February, 2025

Geography: Rochester, NY

Services: Detailed policy/practice recommendations

Client: City of Rochester, NY

Partners: Eric Hangen (I Squared Community Development Services); Jack Northrup (New England Market Research, Inc.); Roger Blain, Dan Kusic and Tom Malnati (TaxServ Capital Services VA, LLC); Alma Balonon-Rosen and Phillip Bush (Enterprise Community Partners).

Interested in these services for your community? We can help! Contact the Technical Assistance Team »

Get the latest tools, resources, and educational opportunities to help you end systemic vacancy, delivered to your inbox.