Posts Tagged ‘Tax Foreclosure’

This Tax Day, making the case for property tax reform in Detroit

Ineffective property tax systems can have a detrimental community impact. They weaken the delivery of services that improve quality of life for local residents – from essential functions like public safety, to supportive services like enforcement of property maintenance standards. Many of the cities that we work in face a shrinking population, widespread property…

Read MoreCharting a new way forward through attorney-practitioner partnerships: Part II —Milwaukee

This is the second in a two-part series exploring how strong working partnerships between practitioners and attorneys can give rise to innovation in the work to reclaim and revitalize blighted properties. Missed Part I—Syracuse? Click here >> Let’s give ourselves a little breathing room In Milwaukee, a productive partnership between Gregg Hagopian, assistant city attorney,…

Read MoreLouisiana passes ballot initiative to return properties to the tax rolls faster

Election Day was a noisy affair: big headlines, big news stories, and a deluge of television coverage, focused mainly on federal elections. Flying mostly below the radar, however, voters also opted “yay” or “nay” on a number of ballot initiatives that could have a big impact on their states. In Louisiana, 54% of voters passed a…

Read MoreIn Honor of Tax Day: A Crash Course in Tax Foreclosure Reform 101

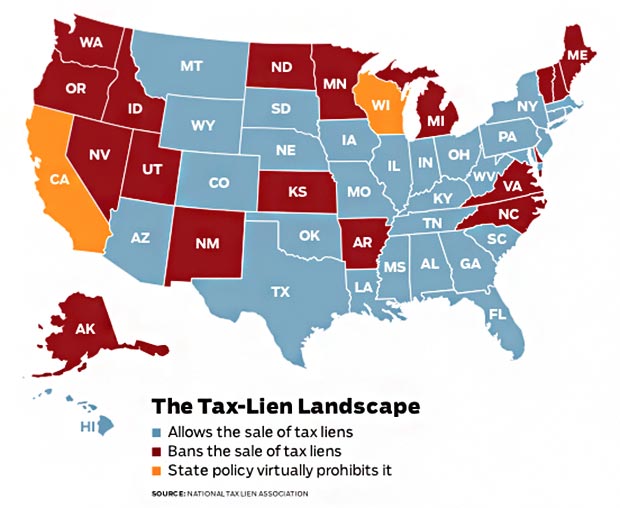

In the midst of flurries of W-2s and fingers crossed for refunds, we’re taking the opportunity on this Tax Day to break down a different tax-related challenge: delinquent property tax foreclosure reform. It’s a mouthful, and it can be complex, but tax foreclosure systems have a big impact on the fight to reclaim blighted, vacant…

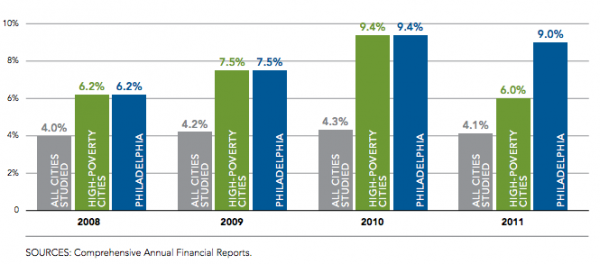

Read MoreProperty tax madness: Another part of the Detroit puzzle

There are many reasons that Detroit has filed for bankruptcy, and some have already been explored by others on Rooflines. Detroit’s problems have accumulated over decades, and are a paradigm of the trajectory of dozens of cities in the United States undone by suburbanization, flight to the Sunbelt, deindustrialization, and a political system that rewarded all three.…

Read MoreEfficient property tax collections vs. the cult of homeownership

Cross-posted from Next City, this article is part of the 2013 Reclaiming Vacant Properties Conference liveblog series. Check out all the in-depth content — even if you weren’t able to join us in Philadelphia from September 9-11, 2013, you’ll feel like you did! This morning’s session “Making the Case for Efficient, Effective and Equitable Tax Foreclosure Reform” raised…

Read More